ESG Data

Simplify ESG reporting

Streamline sustainability reporting on private debt with our purpose-built solution that combines market-leading technology, dedicated analysts and company-sourced data.

ESG reporting, minus the complexity

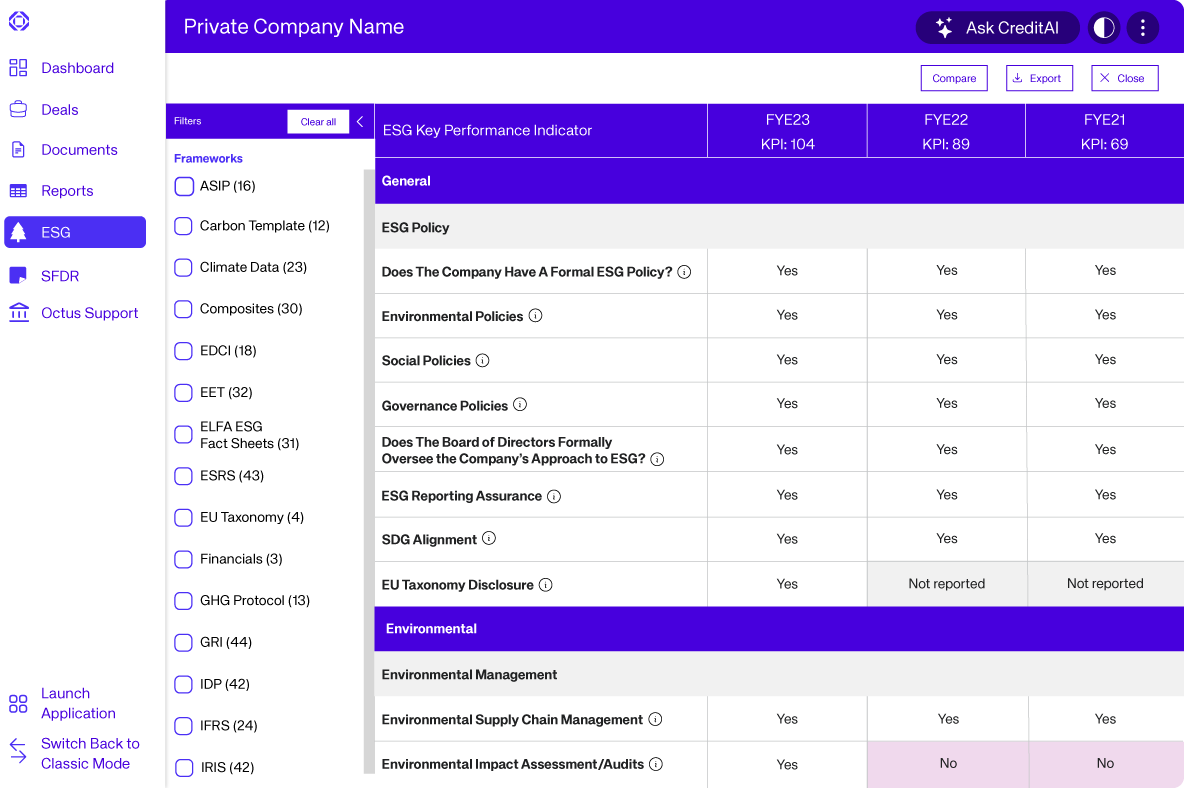

Meet ESG reporting standards

Fulfill your contractual needs and satisfy ESG reporting regulations with access to our comprehensive public and private company ESG KPIs – including auditable, supporting sources.

“Helps me get in the know! – Senior Analyst, advisory firm

Enable your clients’ success

Leverage market-leading ESG analysis to transform the client experience. Give expert advice on data availability and reporting needs and standards based on ESG best practices.

Enhance investor demand

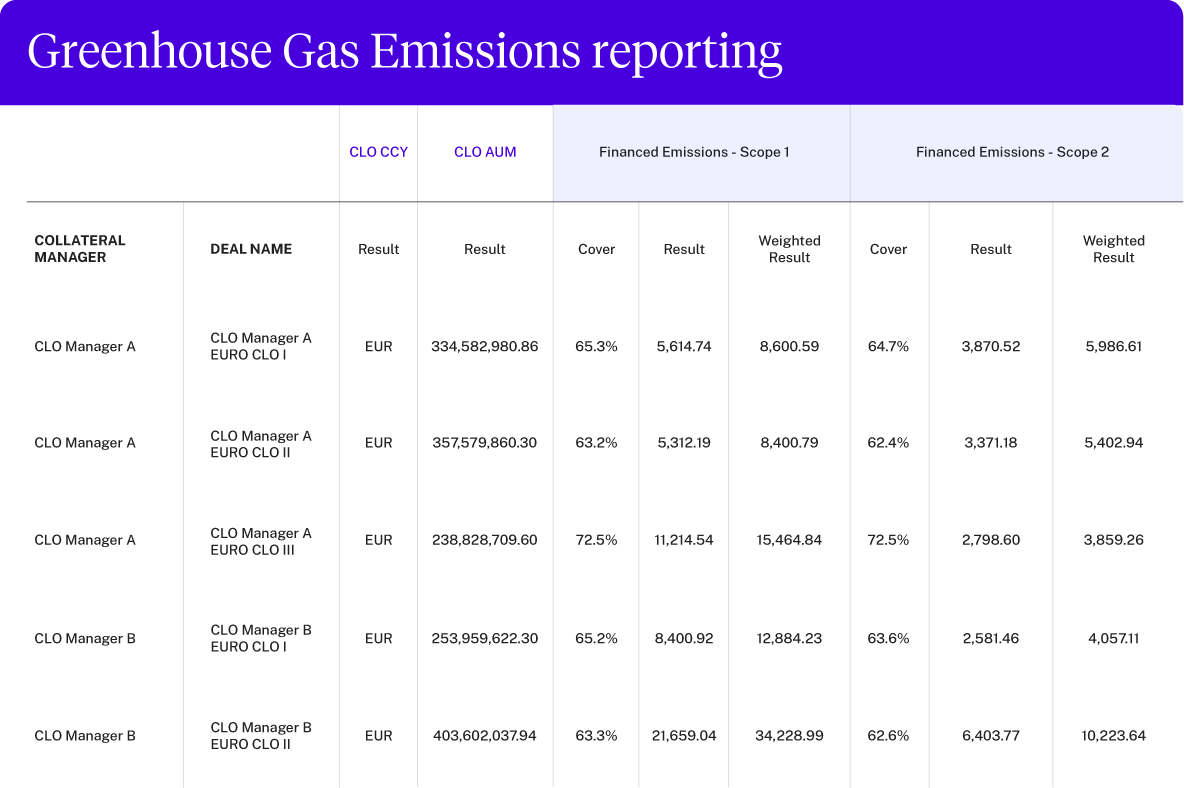

Amplify your impact with seamless ESG integration. Our full ESG reporting platform provides on-demand reports and powerful comparative analytics on CLO ESG weighting.

“The data I receive is credible and transparent. – ESG Analyst, international financial services group

Elevate CLO manager and portfolio performance

ESG Composites by Octus integrates CLO holdings data with private company financial and ESG data, giving CLO investors and managers actionable insights and the ability to report on key ESG metrics.

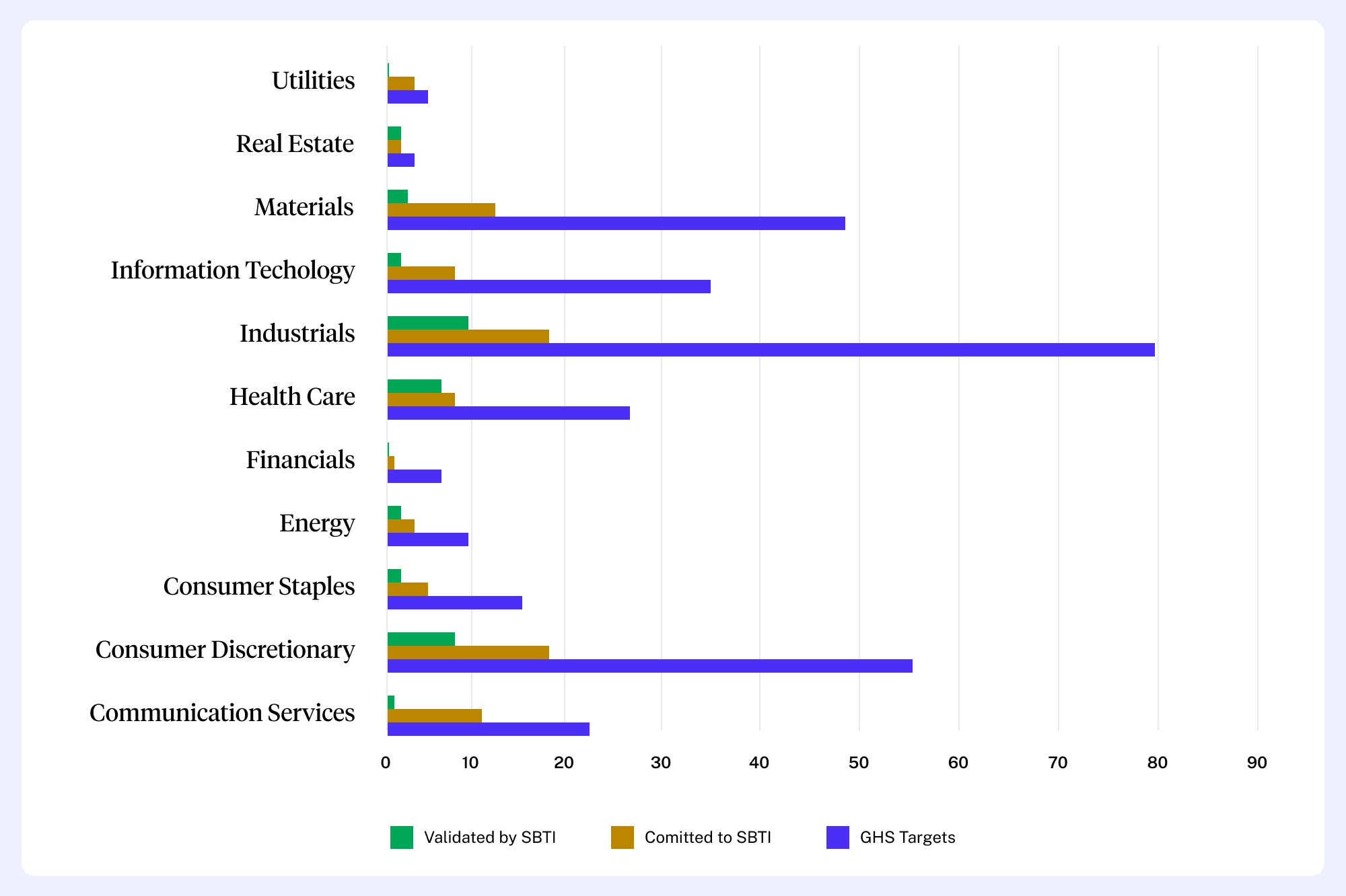

Identify opportunities with ESG Primary Analysis

Make better informed investment decisions and identify new and hidden opportunities with expert and market-leading ESG primary analysis on all new BSL issuances in EMEA and select issuances in the US.

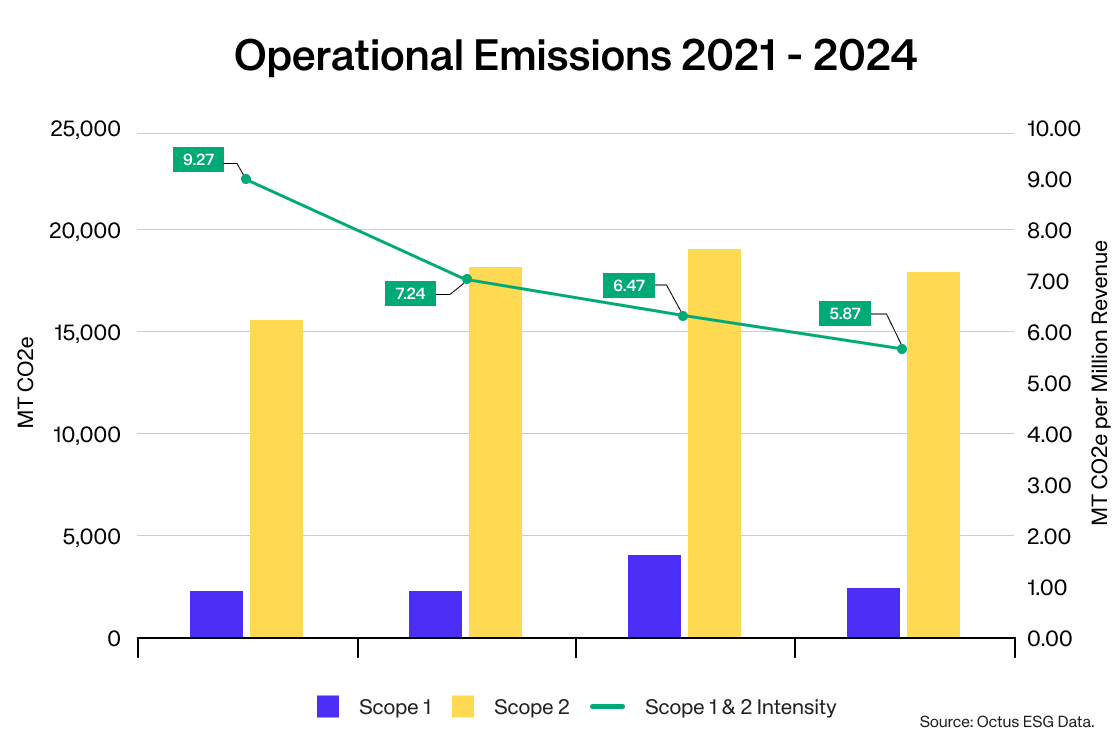

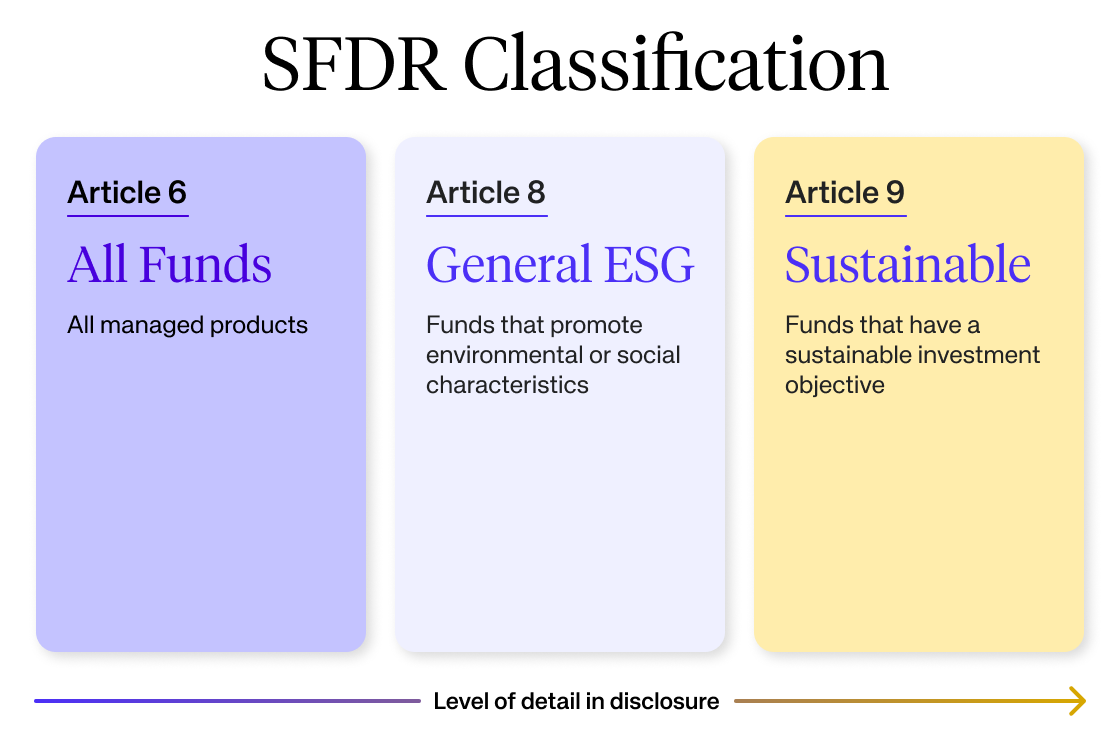

Clarify SFDR reporting

Achieve clarity and accuracy in SFDR compliance. Octus provides a robust data and reporting solution that maps fund holdings to issuer-level ESG information, including indicators required under the PAI framework.

Trusted by professionals

Investment managers, lenders and ratings agencies utilize ESG Data for regulatory reporting and investment underwriting under ESG.

4,000+

Global issuers covered

120

KPIs mapped

25+

Global ESG frameworks

Regulatory Reporting Resources

On November 20, the European Commission unveiled a major legislative proposal to overhaul the Sustainable Finance Disclosure Regulation. Dubbed SFDR 2.0, this move aims to replace existing primary and delegated regulations with a more efficient framework, signaling a significant shift in how sustainable finance is governed in the EU. Learn more about SFDR and ESG Reporting.

Who we serve

Global professionals rely on Octus to deliver the proprietary data and actionable intelligence that informs and accelerates their most critical decisions.

Seamless sustainability reporting

Purpose-built by professionals for professionals, our ESG Data provides standardized ESG and sustainability reporting solutions for the leveraged finance and private assets markets.