Credit Intelligence

Make confident credit decisions with verified, real-time global data and intelligence

Access insightful, detailed and accurate data and analysis across every stage of the credit lifecycle. Go from credit chaos to credit calm.

One view gives you every angle

So many experts, so many places

Non-stop news and analysis from around the globe and coverage across the full credit lifecycle, including performing, stressed, distressed, restructuring and post-reorg.

100+

countries where we continuously cover new and developing names.

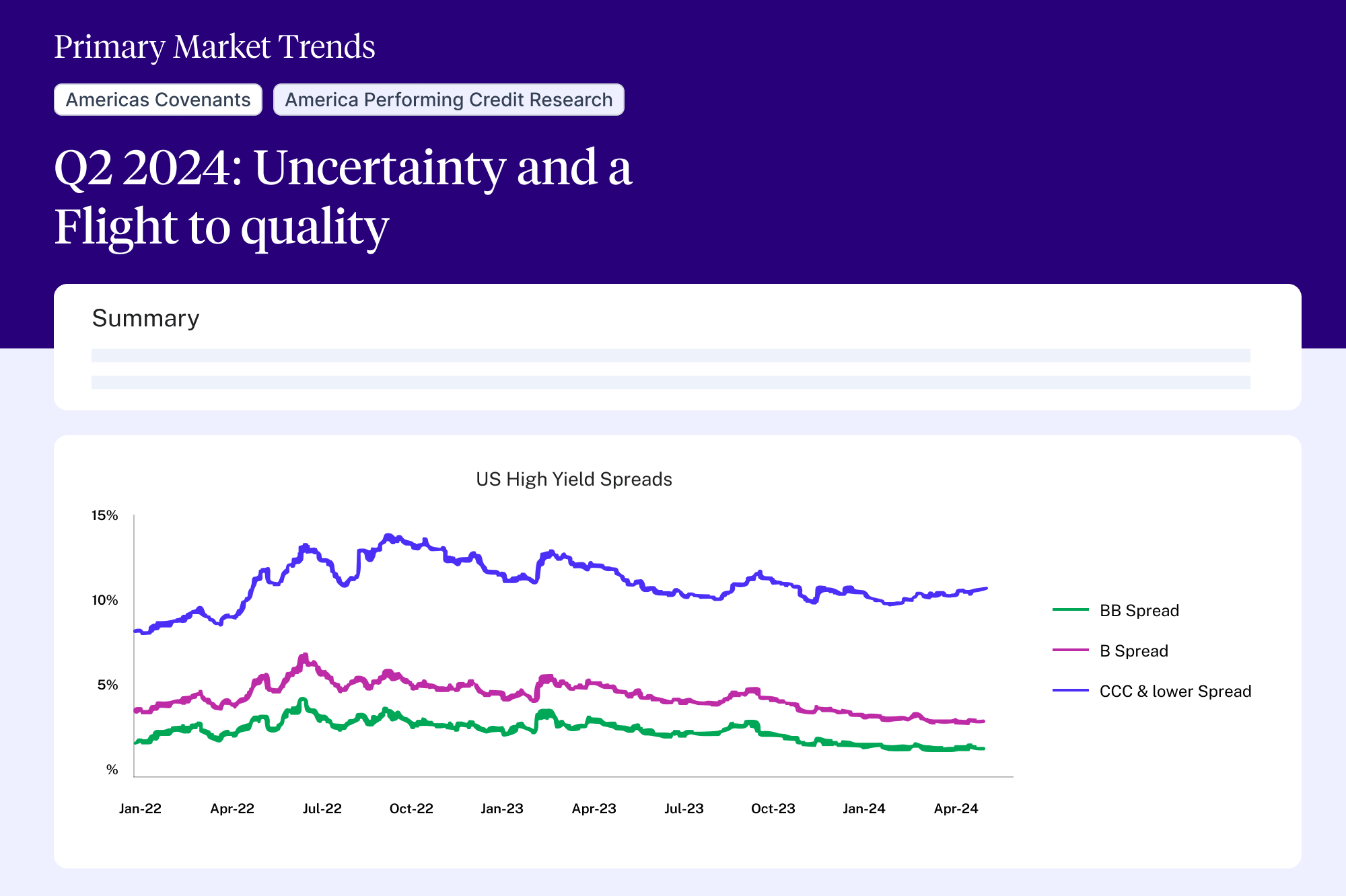

Your edge in the primary market

Stop chasing data and start using it. The Octus Primary Tracker delivers instant, interactive access to the primary bond and loan markets in the US and Europe. With daily updates on pricing, sponsors, and bookrunners, you can benchmark terms and spot emerging trends before the competition.

50+

data points across deal characteristics, sponsor, use of proceeds and more

Saving hours and saving the day

Access to expert analysis and research streamline your workflow, helping you save time and associated costs and make better-informed decisions faster.

“Octus likely reduces the time it takes me to evaluate a credit or company by about 15-20% – sometimes more!” – Associate, Eldridge Industries

The deepest insights, bar none

Our trifecta of legal, financial and reporting expertise provides the most robust content and data around high-yield and distressed debt, ensuring you never miss critical information; whether it’s yesterday’s precedent or the details behind tomorrow’s opportunity.

“Octus provides comprehensive reporting and an always improving database of synthesized data. –Senior Director, FTI Consulting

Speed, accuracy, agility

Jeremy Landau, of IVO Capital Partners, and his team rely on accurate, efficient, clear information to thoroughly analyze and confidently seize investment opportunities.

“Learn how the team uses Octus to get aheadInitially, Octus provided an edge; now, it's essential. It's no longer optional; it’s necessary.

Metrics that matter

These figures reflect the strength, scale, and expertise of Credit Intelligence, providing unrivaled insights to global users, supporting their discovery, research, pitching and investment decisions.

50,000

stories published globally per year.

36,000

global users who turn to Octus Credit Intelligence for insight.

260+

expert journalists, financial, legal and data analysts on staff.

Deep in thoughts

Plumb the depths of Credit Intelligence. Uncover expert-backed legal and financial insights that will help you navigate complex credit situations and enable you to capitalize on every opportunity.

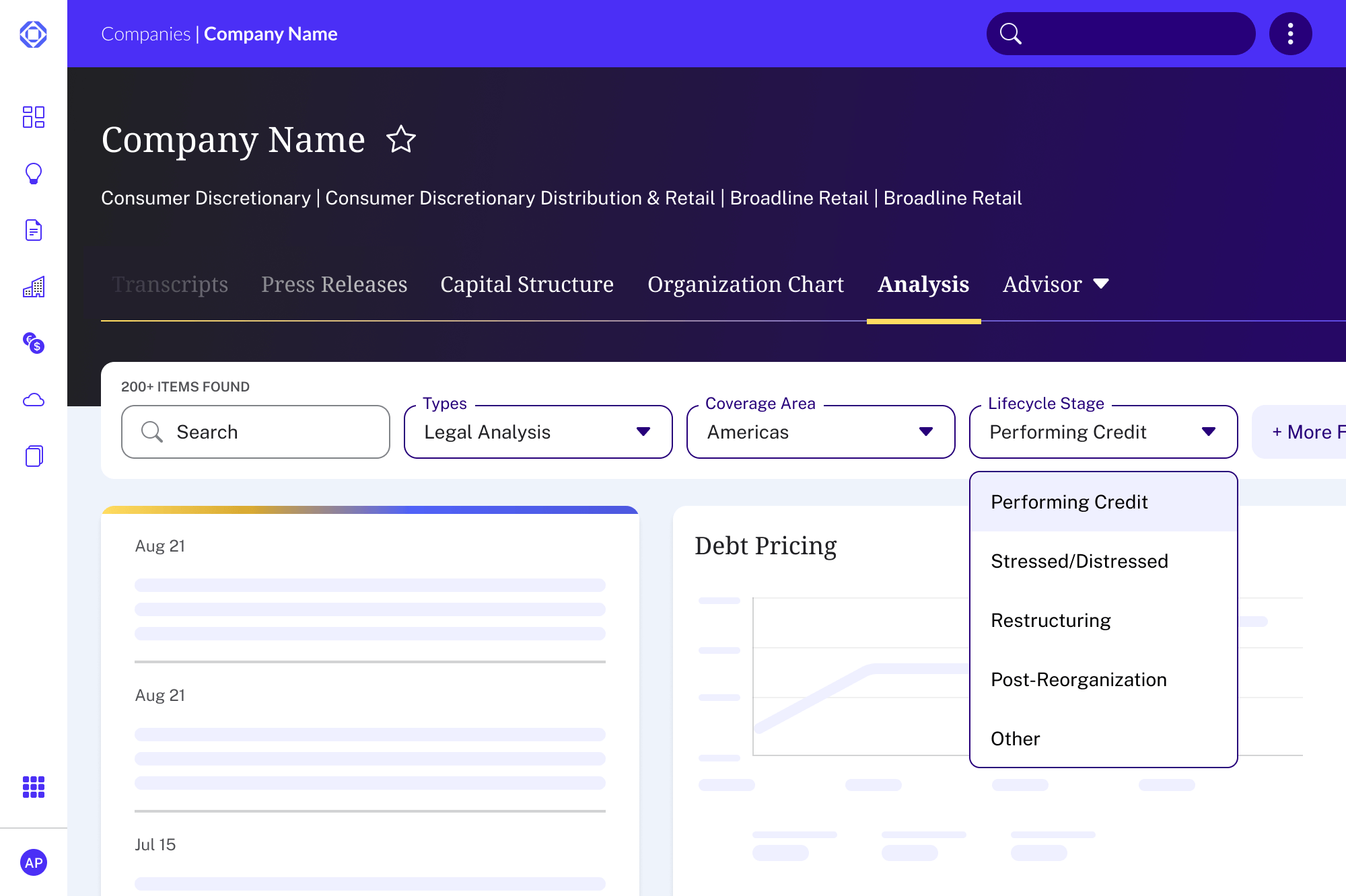

Unparalleled data

The ability to easily analyze and compare across the full credit lifecycle is at your fingertips. Credit Intelligence opens up access to the industry’s leading proprietary data sets.

Advisors

Search and filter by jurisdiction, country, sector and advisor type

CLO

Access, search and sort through syndicated loan ownership data

Debtor-In-Possession (DIP) Financing

Dive into detailed information on DIP loans sized at $1 million and above

Legal Billing Rates

Compare law firm billing rates head-to-head

Key Employee Incentive Plan

Access to key economic, legal and case data points formatted to mimic typical analysis of incentive plans

Unsecured Creditors

Examine the nature, amount and status of unsecured claims

Who we serve

Global professionals rely on Octus to deliver the proprietary data and actionable intelligence that informs and accelerates their most critical decisions.

Buy Side Firms

Fuel your research and due diligence to optimize portfolios and mitigate risk.

Advisory Firms

Identify opportunities and deliver high-value, data-driven recommendations.

Contact us

Who couldn’t use a stronger credit strategy? Let Octus Credit Intelligence be your superpower, providing you with a competitive edge in sub-investment grade credit. Connect with Octus today.