Liquid Credit Fundamentals

Harness the power of full-universe credit data

The most comprehensive coverage of private and public European and US leveraged loan and high-yield bond issuers in market.

Move before the market does

Comprehensive coverage across markets

Access the full spectrum of financial data without gaps. Make informed decisions based on the most complete, up-to-date information available. Critical data for thorough market analysis and portfolio monitoring.

9,000

transcripts in the Fundamentals library

Industry leaders agree

Liquid Credit Fundamentals is an indispensable tool for credit market participants. It delivers ease and simplicity even as the volume and sources of financial data add continual complexity to credit analysis.

“The Fundamentals product is timely, offers breadth and depth of accurate information that is both intuitive and clear. – Analyst, AXA Investment Managers

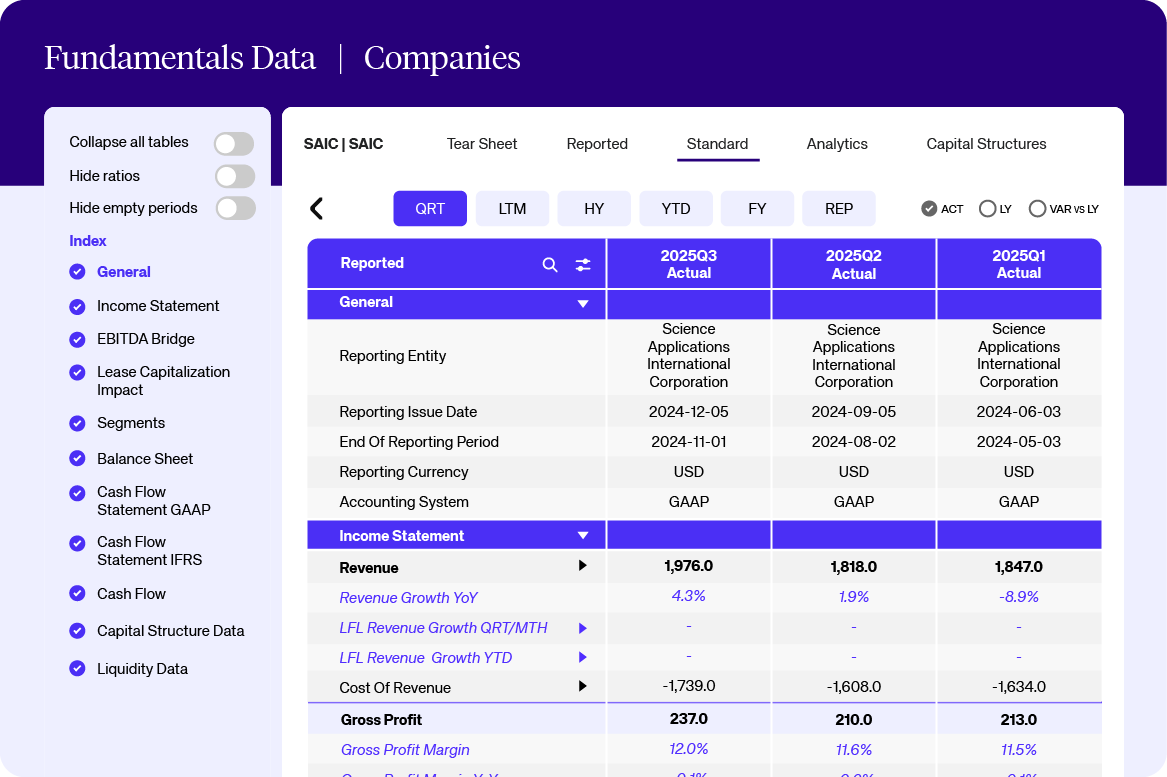

Fundamental data, on demand

Octus has combined the best of the best fundamental data into one platform. It is the largest library of models on public and private issuers, built by the largest team of analysts in the industry. Quickly get up to speed on a credit with tear sheets, which provide a quick snapshot of a company’s key financials, including a capital structure, valuation, sponsor and business description.

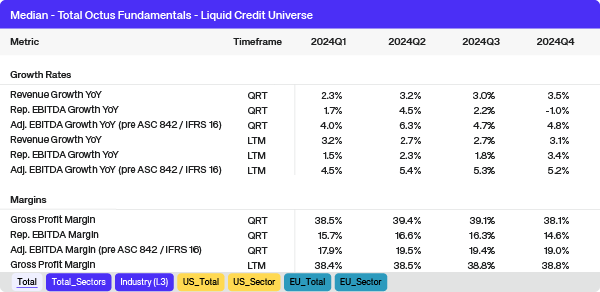

The only market data you’ll ever need

Visualize and analyze the entire leveraged finance universe instantly with Liquid Credit Universe market data. Compare portfolios, track key stats and uncover strategic insights with comprehensive data on public and private issuers.

Get straight to comparison

Fundamentals Comparables cuts through the market clutter. Instantly generate a precise peer group based on the criteria that matter most: Industry, Region, and Adjusted EBITDA Range, then download to Excel for further analysis.

Strong, risk-adjusted performance

Firms like 2E Capital use Fundamentals data to quickly access critical data and transcripts, enhance their workflows and drive business performance.

“Read Vic's StoryAccess to transcripts has made it a lot easier for me to get up to speed on a lot of situations… That context is a tool I use to pull together a mosaic and form the best picture I can of an opportunity.” – Vic Danh, 2E Capital Partners

Our reach, your edge

Fundamentals Data provides unparalleled access to crucial financial insights and market trends. Our comprehensive reach and deep analysis equip you well to make strategic, data-driven decisions.

~3,000

issuers’ financial data covered across U.S. and EMEA markets.

1,000+

deals analyzed for structuring and valuation comps.

10+

years of historical financial data to inform your analysis.

Leverage insights to stay ahead

Uncover actionable insight with Fundamentals Data. The market-leading platform for timely financial intelligence, deep analysis and the very tools you need to navigate and capitalize on market opportunities.

The best fundamental data, on demand

Fuel your financial models with fundamental data—where and when you need it. Power your workflow with full-universe coverage of issuers in the platform built by the industry’s largest team of analysts.

Optimize your workflow

Expedite workflow with FinDox integration. Access critical data directly via upgraded Excel add-in or REST API.

Make better informed decisions

Screen the entire universe with standardized metrics. Assess credits with cap structures, Octus intel and historical models.

Identify and maximize opportunities

Identify opportunities with full-universe issuer coverage and enhance portfolio monitoring.

Quickly assess a credit

Get a quick view of a company’s financials with tear sheets showing cap structure, valuation, sponsor and business description.

Transcripts

Easily access public and private transcripts* directly from the company page.

Earnings flash updates

Act quickly with near real-time updates and stay ahead in fast-moving market conditions.

*Private transcripts are only available to subscribers who are under non-disclosure agreements for named issuers.

Who we serve

Global professionals rely on Octus to deliver the proprietary data and actionable intelligence that informs and accelerates their most critical decisions.

Buy Side Firms

Fuel your research and due diligence to optimize portfolios and mitigate risk.

Advisory Firms

Identify opportunities and deliver high-value, data-driven recommendations.

Contact us

Do you have the most complete set of comparables? Why run after data when it can run to you? Harness the power of full-universe coverage. Connect with Octus today.